On 6th of July the trading in the shares of Homes & Holiday AG (ISIN: DE000A2GS5M9) began on the Munich Stock Exchange (quality segment m:access).

As part of the IPO, the specialist for holiday properties placed 1,757,595 shares at a price of EUR 2.50 from a capital increase. Including the pre-IPO capital increase in April 2018, the company received gross proceeds of EUR 5.8 million to accelerate growth.

For Homes & Holiday, the focus in the coming years is clearly on increasing sales and booking revenues. The Group will continue to focus on Europe’s most attractive holiday property markets: Spain and Germany.

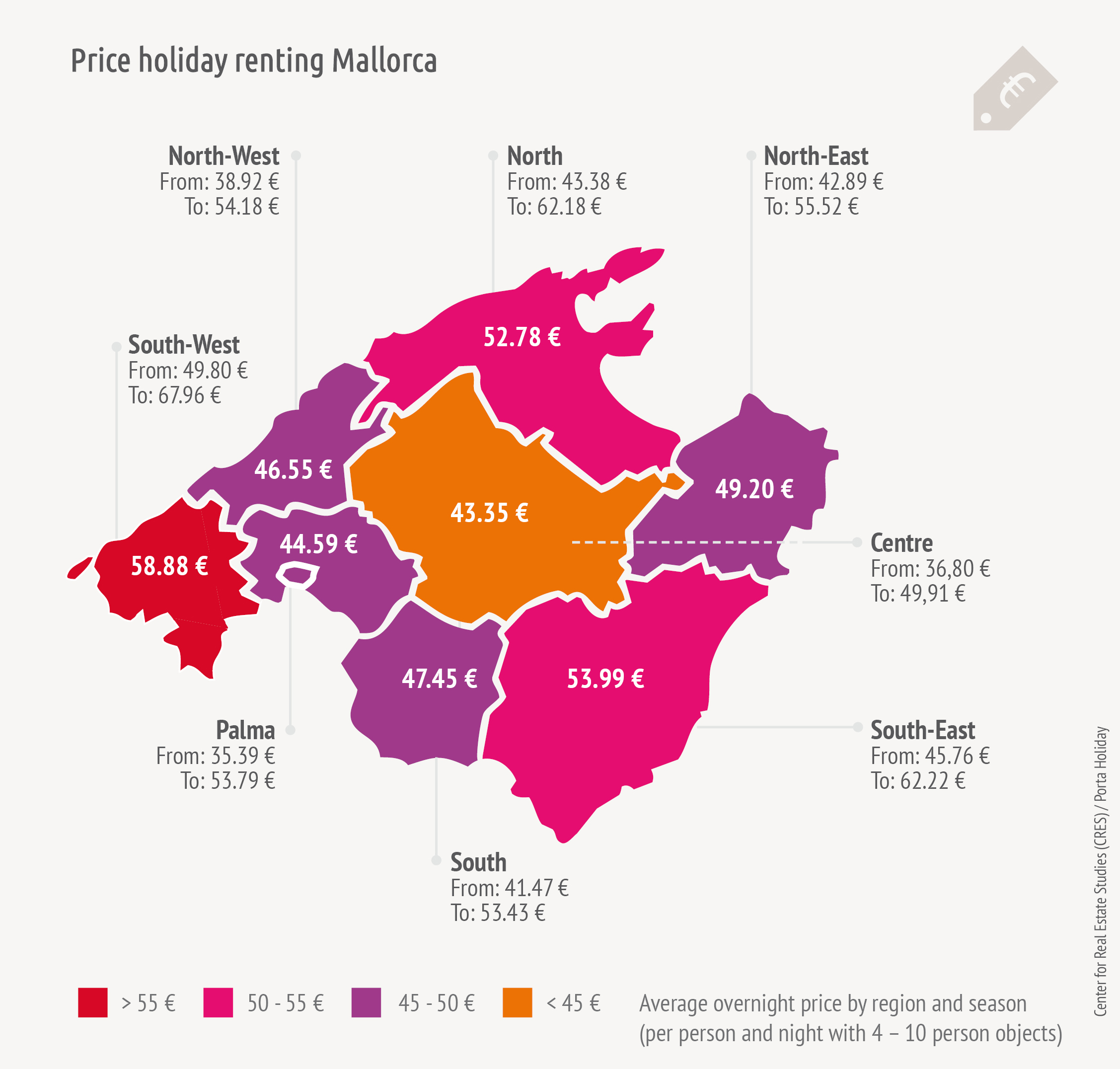

The Balearic Islands, the Canary Islands, the Spanish Mediterranean coast and, in Germany in particular, the North Sea, the Baltic Sea and southern Germany offer considerable potential. In addition to organic growth, existing real estate brokers and holiday rental companies are also to be taken over.

Analysts recommend to buy

The analysts at GBC Research are also convinced of the Group’s positive future prospects. Against the backdrop of the successful IPO and the funds thus secured to accelerate growth as well as the still favourable conditions, the analysts today confirmed their assessment and forecasts from the IPO research study. You recommend buying the Homes & Holiday share with a target price of EUR 4.83. The complete study is available on more-ir.de/d/16559.pdf.

After the IPO in the m:access quality segment of the Munich Stock Exchange, the shares of Homes & Holiday AG (ISIN: DE000A2GS5M9) are now also tradable on other stock exchanges.

The specialist for holiday properties is also listed on the Frankfurt Stock Exchange and Xetra as part of asecond listing. mwb fairtrade Wertpapierhandelsbank AG acts as a specialist (Frankfurt) and designated sponsor (Xetra).

As part of last week’s IPO and the pre-IPO capital increase in April 2018, Homes & Holiday AG received (gross) EUR 5.8 million to accelerate growth. This enables the company to consistently implement its buy and build strategy within the scalable business model from brokerage to holiday rental with property management.

About Homes & Holiday AG

The Homes & Holiday AG is based in Munich and and was the first franchise system, together with its subsidiaries Porta Mondial, Porta Mallorquina and Porta Holiday, to specialise in holiday real estate.

Within an integrated business model the group offers all services including classic real estate brokerage (Porta Mondial/Porta Mallorquina), holiday renting (Porta Holiday), and property management (via external service providers). Thereby the group concentrates with its 21 locations, on Spain and Germany, Europe’s most attractive real estate markets.

In 2017 the Homes & Holiday group increased its sales and booking turnover by more than 47% up to over 139 million euros.